Papeles de transferencia – Guía de compra, presentación y prueba ¿Tiene ropa que parece bastante común y le gustaría personalizarla…

Leer masRodillos – Guía de compra, clasificación y pruebas ¿Estás buscando nuevas disciplinas para mover tu corps ? Todos tus músculos estarán…

Leer masChalecos con airbag – Guía de compra, clasificación y pruebas La equitación es una disciplina que puede ser peligrosa. Caer…

Leer masA mucha gente le gusta la caza del tesoro. No sólo los niños disfrutan de este juego, sino también los…

Leer masEl descubrimiento de un tesoro es totalmente confuso para los particulares. Muchos cultivadores los encuentran sin querer en los campos….

Leer masEn busca de tesoros enterrados en las profundidades del subsuelo, muchas personas se aventuran a buscar oro usando un detector…

Leer masLa ventaja principal La herramienta se complace por la riqueza y precisión de sus datos. Esta característica hace mucho más…

Leer masLa ventaja principal Este modelo tiene una resistencia al agua de hasta 3 metros. Por lo tanto, es adecuado para…

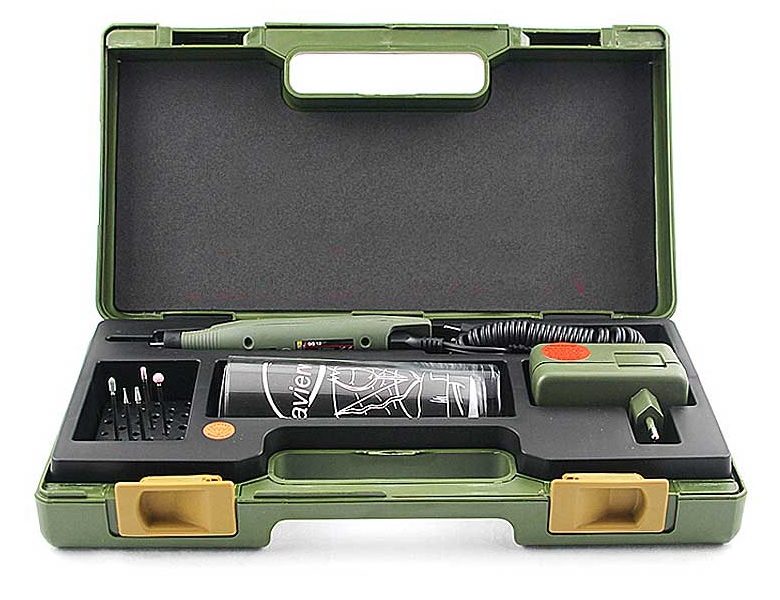

Leer masPiratas: Reseñas y comparación de los mejores modelos La pirograbación no es un arte que sólo los profesionales pueden dominar….

Leer masVentaja principal: Este dispositivo es fácil de manejar y no causa ningún problema al usuario. Por lo tanto, incluso un…

Leer mas¿Recuerdas la clase del jardín de infantes donde todavía jugabas con la masa en modeler ? Ciertamente te divertiste mucho haciendo…

Leer masUn “deber” para los pequeños, esta masa con múltiples posibilidades hace soñar a los niños. Les permite dar rienda suelta…

Leer masUn “deber” para los pequeños, esta masa con múltiples posibilidades hace soñar a los niños. Les permite dar rienda suelta…

Leer masLa ventaja principal Este dispositivo garantiza su rendimiento, gracias a la tecnología integrada de inducción de pulsos. Es capaz de…

Leer masFimo Pasta – Guía de compra, clasificación y pruebas en 2020 Como su nombre lo indica, la arcilla de Fimo…

Leer mas